Perform Like an Elite Trader

The only trade journal built for prop traders. Track multiple accounts, document every decision, build your playbooks, and develop systematic edge like a pro.

How Do Elite Traders Achieve Consistent 6-7 Figure Yearly Performance?

The answer isn't more indicators or secret strategies. Elite traders build systematic processes that transform every trade into measurable improvement. They develop their edge deliberately, not accidentally.

Here's How

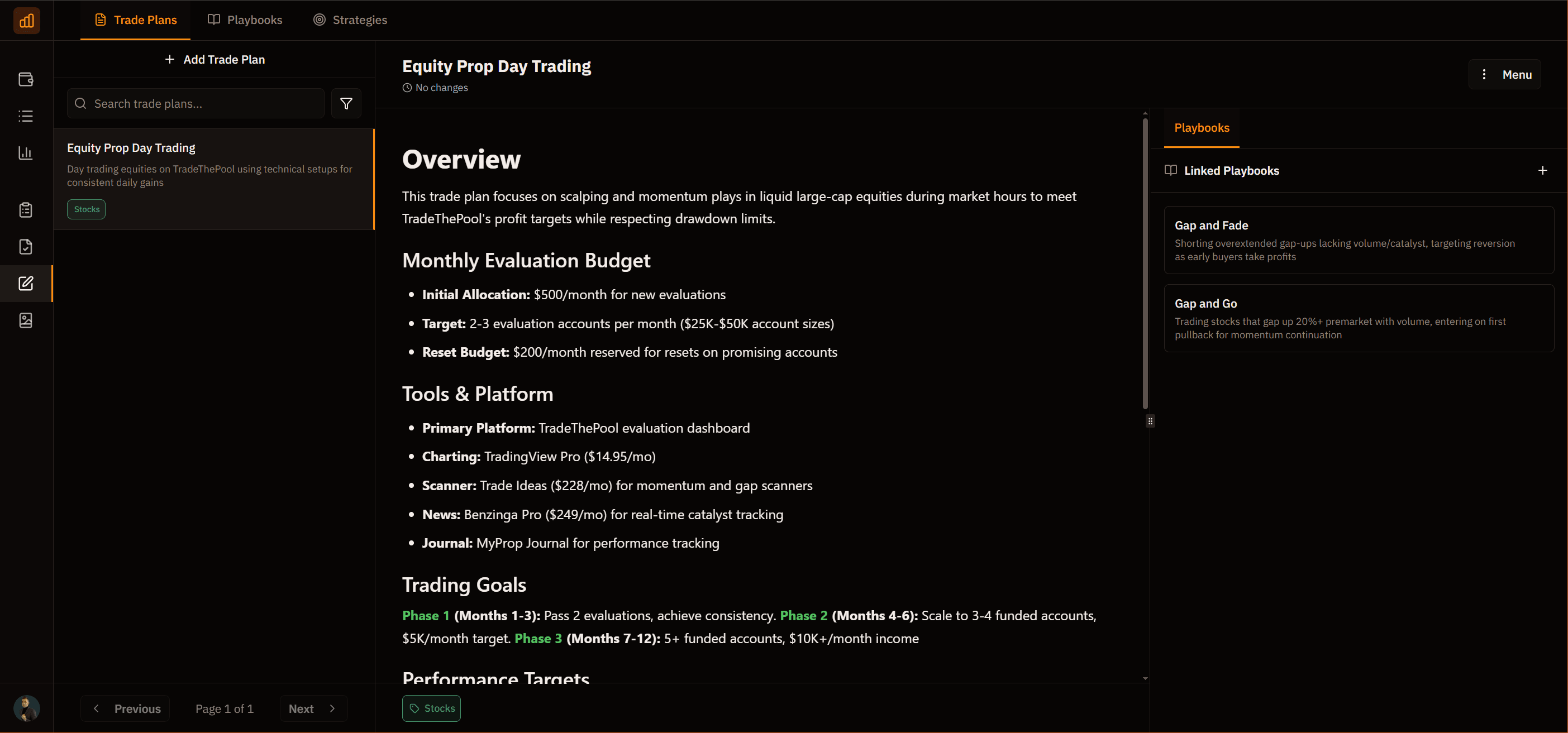

Elite Traders Build and Refine Their Trade Plans, Playbooks, and Trading Strategies

Elite traders build comprehensive trade plans that define their approach, risk parameters, and execution rules before entering any position.

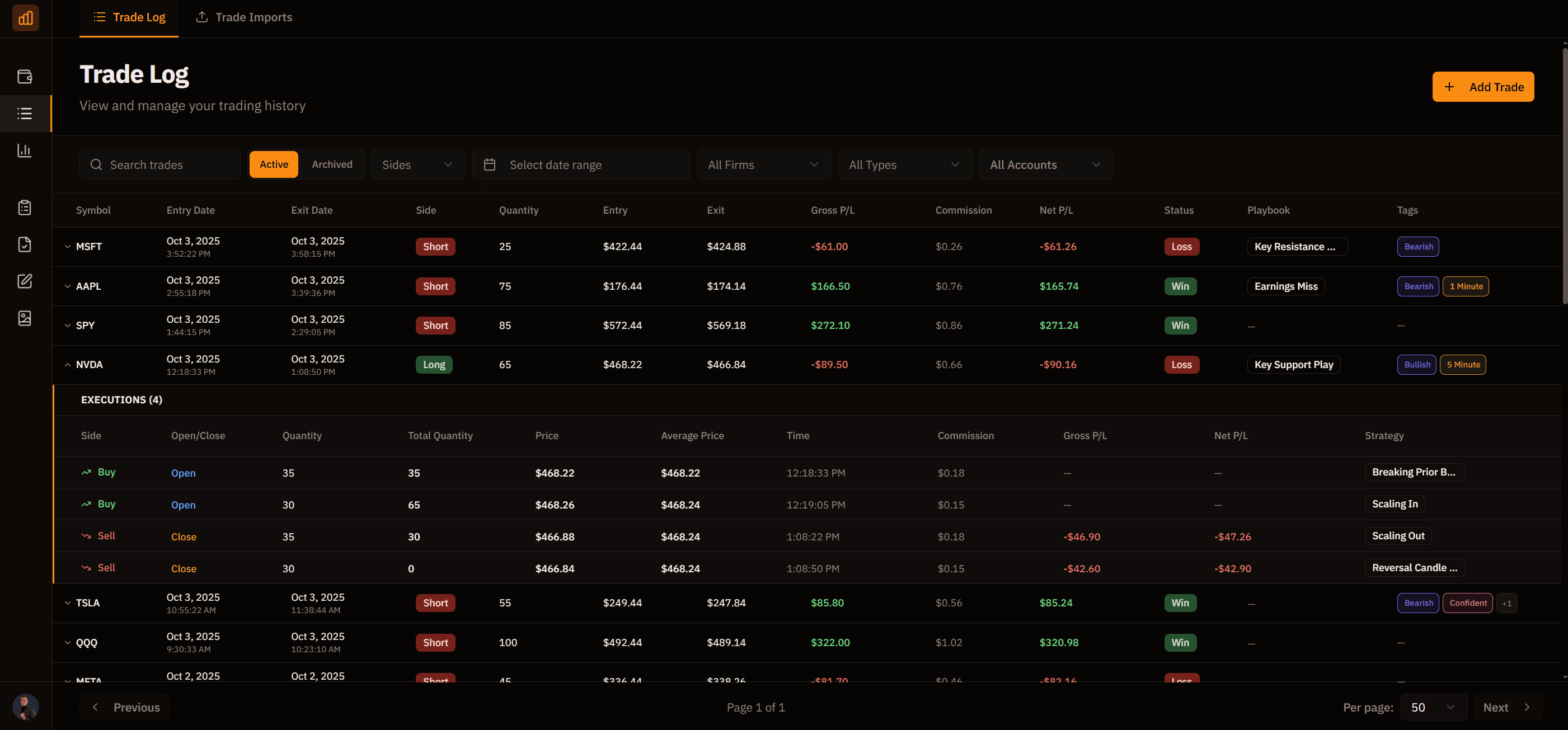

Elite Traders Execute With Precision and Track Every Decision

Elite traders meticulously document every execution with precision. They import or manually add trades, maintaining a complete record of every decision and outcome.

Each trade is linked to specific playbooks and strategies. Every entry signal, exit signal, and execution detail is tracked systematically for future analysis and improvement.

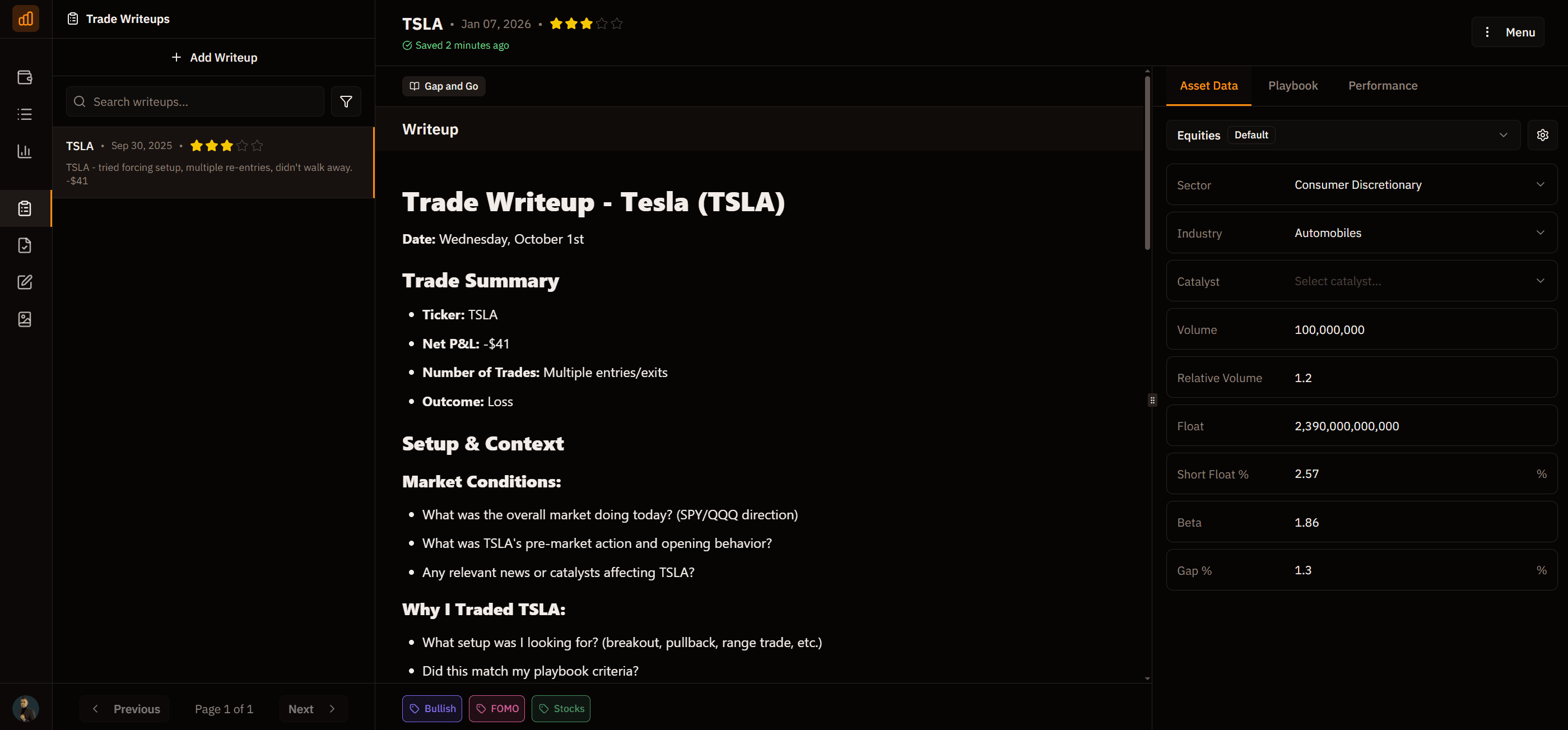

Elite Traders Conduct Deep Post-Trade Analysis on Every Significant Position

Elite traders document their complete thought process for every significant trade. They capture what they saw, why they entered, how they managed the position, and why they exited.

Each write-up includes playbook criteria checklists, ensuring every decision aligns with their proven strategies. This systematic review process transforms experience into measurable skill improvement.

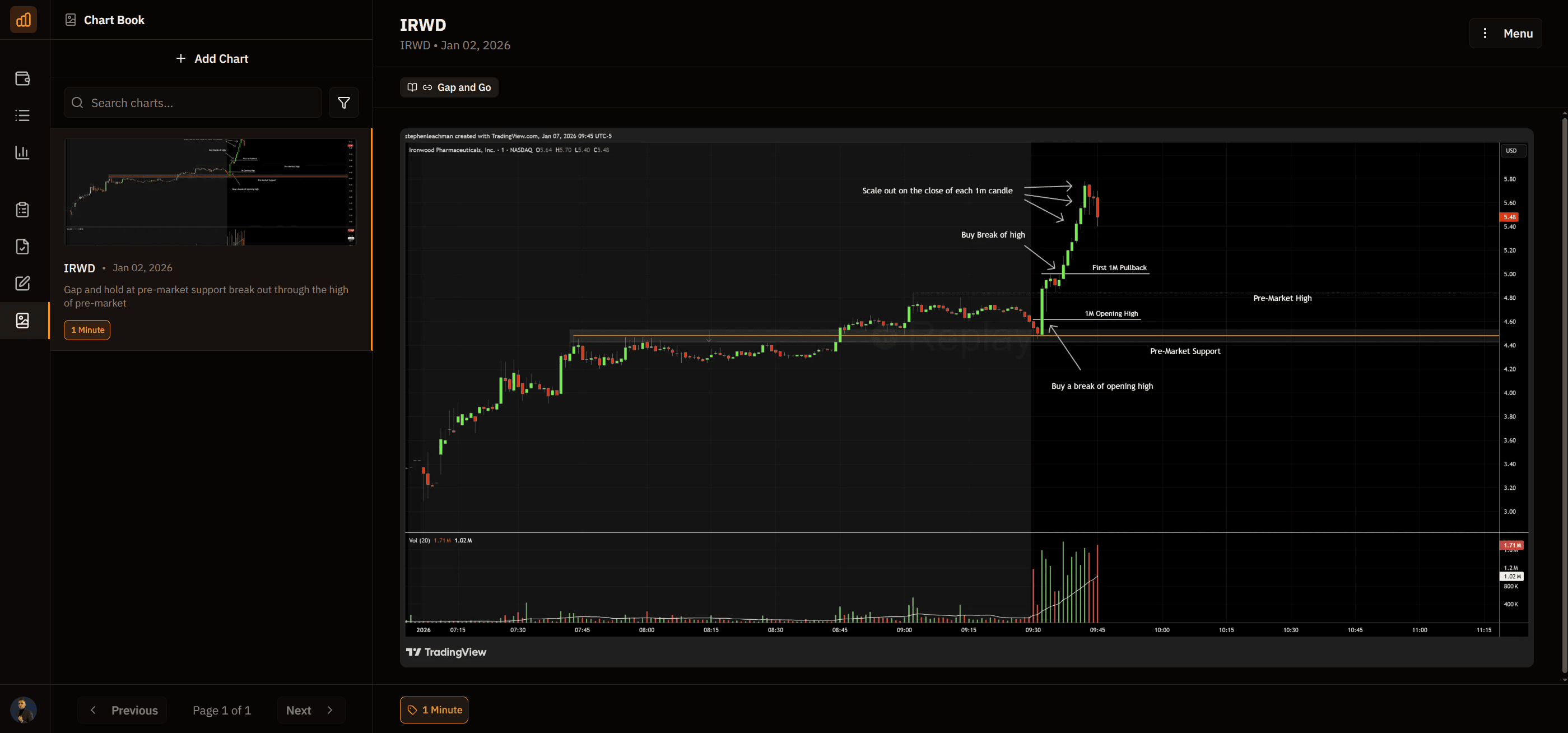

Elite Traders Build Visual Libraries to Accelerate Pattern Recognition

Elite traders create annotated chart libraries of patterns, setups, and key price action. Each chart is marked with entry signals, exit points, and critical decision-making moments.

This visual database trains their eye to recognize high-probability setups instantly. Pattern recognition becomes automatic through systematic review of documented examples.

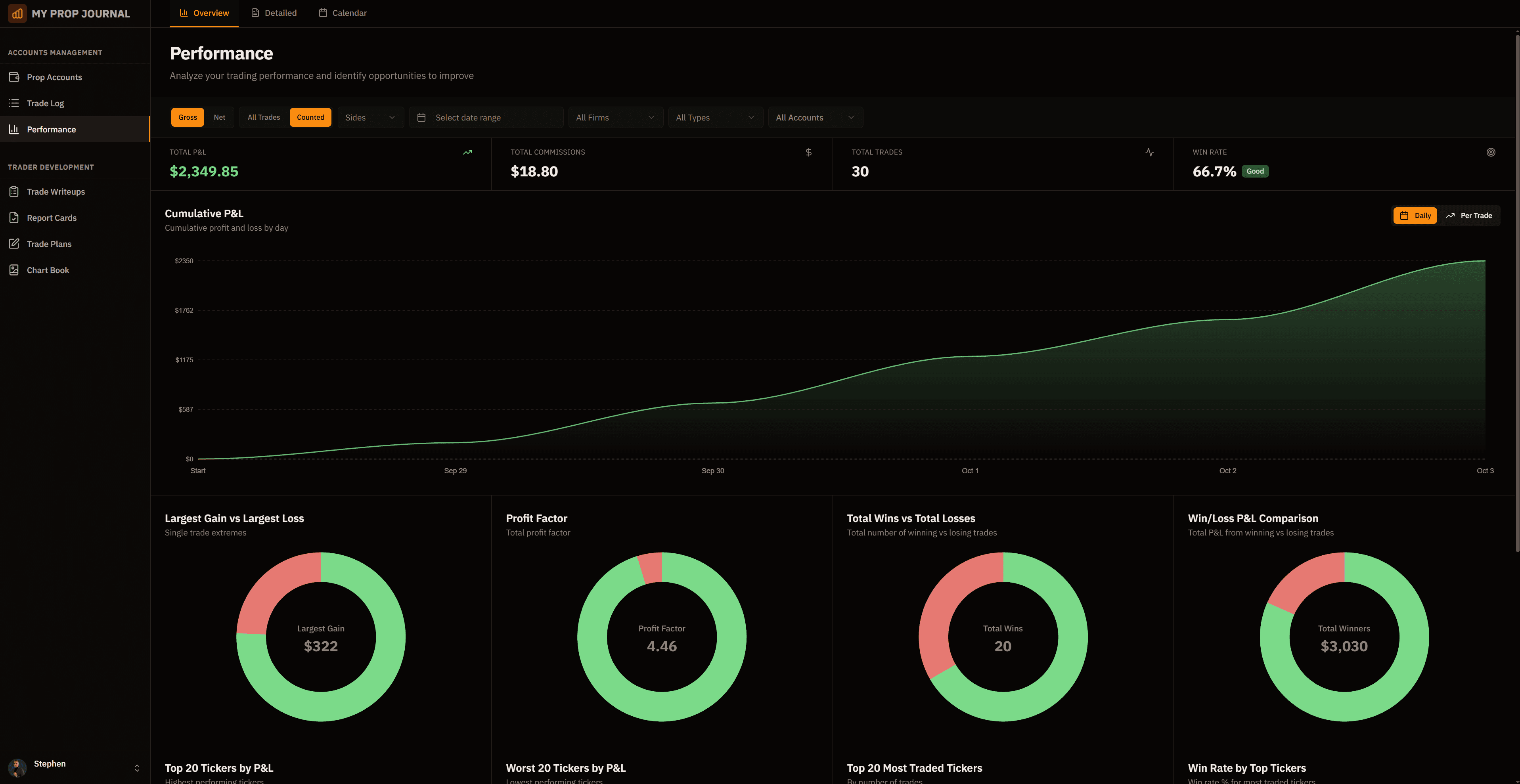

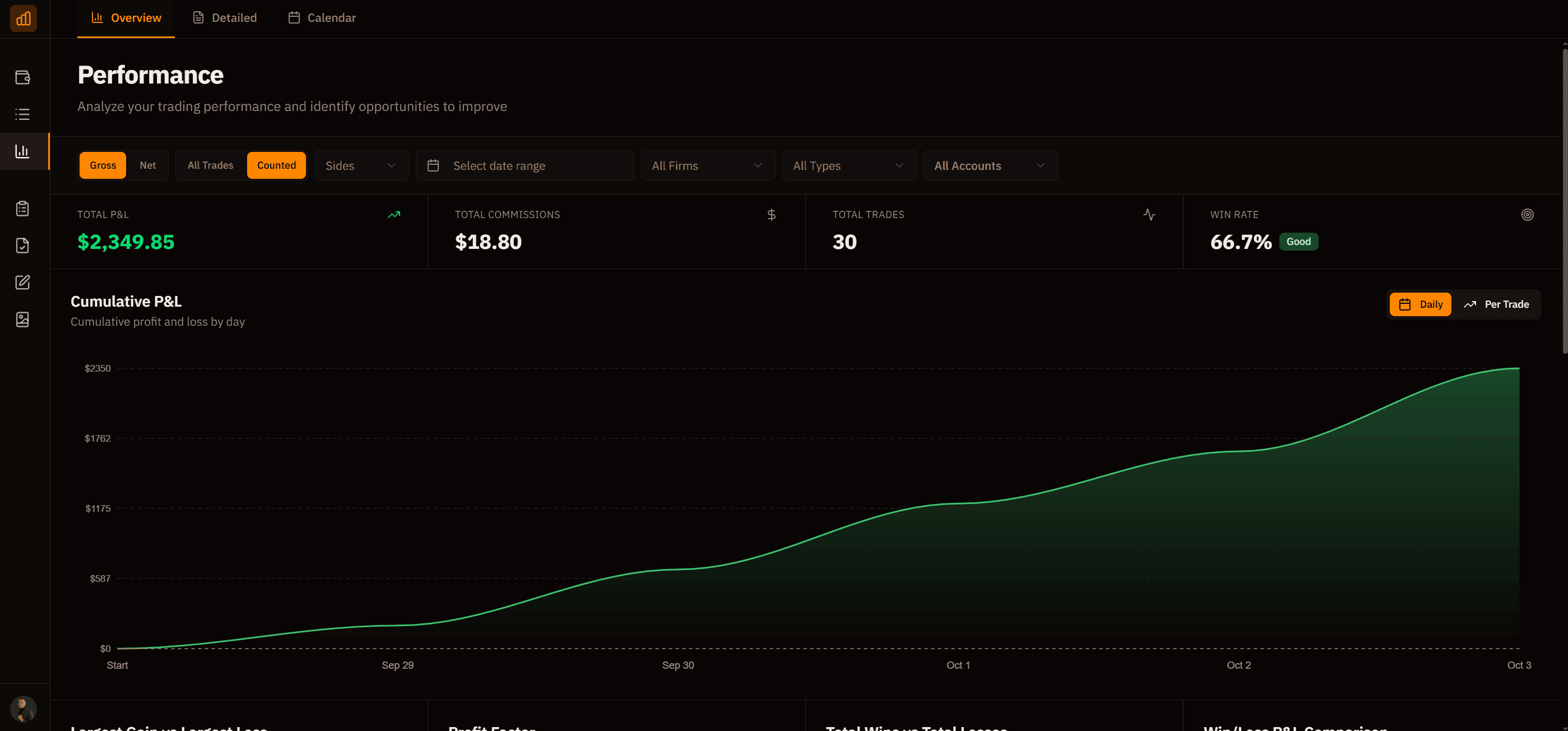

Elite Traders Measure Everything and Optimize Systematically

Elite traders track key metrics at a glance: win rate, profit factor, largest gains versus losses, and top performing tickers. Every number tells a story about their edge.

Elite Traders Conduct Regular Performance Reviews and Extract Actionable Lessons

Elite traders document their lessons learned, execution quality, and areas for improvement. Each report card captures what worked, what didn't, and specific action items for the next period.

Elite Traders Don't Rely on Luck. They Build Systems.

The difference between consistent six and seven-figure traders isn't talent or secret strategies. It's systematic development. Elite traders document every decision, measure every outcome, and refine their edge deliberately. This is hard work that requires discipline, but this is how professionals are built.

Are You Ready to Do the Work?

Join traders building their edge systematically, one trade at a time.